The Largest Source of Nonprofit Funding Might Surprise You

What’s the largest source of nonprofit funding? I’ll bet you would have a hard time guessing. It’s not donations by individuals.

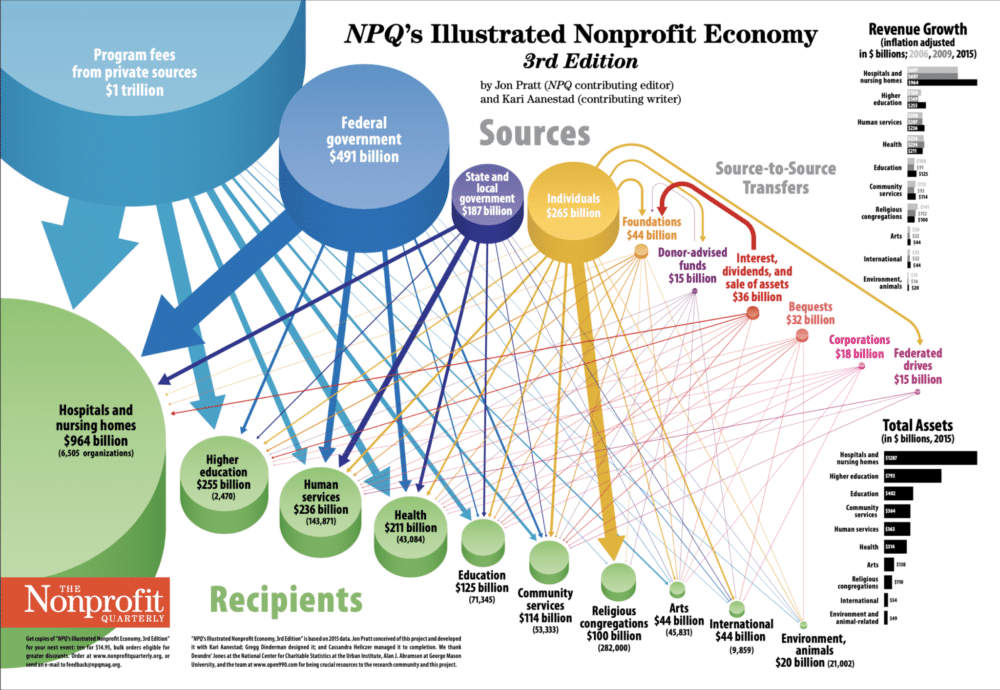

It’s actually program fees from private sources, at nearly $1 trillion annually, according to Nonprofit Quarterly’s 2020 Map of the Nonprofit Economy.* What are program fees? Nonprofit hospitals and nursing homes all charge fees for their services. So do universities, arts organizations, human services organizations and several other types of nonprofits.

And what’s No. 2? It’s still not donations by individuals.

The second largest source of nonprofit funding is the federal government. The federal government pays $491 billion into the nonprofit economy, with the majority of that in the form of program services fees for Medicare and Medicaid. Hospitals and nursing homes receive 57% of the total amount of federal funds that go to nonprofits.

The 3rd edition of Nonprofit Quarterly’s Illustrated Nonprofit Economy provides a fascinating visualization of the complexity of nonprofit funding sources.

Individual donations come in at No. 3 with $265 billion. Nearly 40% of these contributions go to religious organizations. You can see that individual donations go to a wide range of other causes, making up a small but significant portion of their funding. Obviously, some organizations rely on donations much more than others.

Other top sources of nonprofit funding

- State and local government: $187 billion

- Foundations: $100 billion

- Interest, dividends, sale of assets: $36 billion

- Charitable bequests: $32 billion

- Corporate contributions: $18 billion

- Donor advised funds: $15 billion

- Federated drives (i.e, United Way): $15 billion

Are these numbers surprising to you? The federal government pool certainly makes you wonder which are the nonprofits receiving those funds and if they are wisely being used on behalf of all taxpayers.

But it also suggests the necessity of program fees or earned revenue for thriving nonprofits. At the very least, nonprofit organizations should consider diversifying their sources of income beyond just individual donations.

Read more on how your nonprofit can adapt for success in Charity Shock: 10 Critical Trends Revolutionizing the Fundraising World.

*NPQ developed its map using 2015 data from the National Center for Charitable Statistics, along with IRS data. The lag time on comprehensive statistical data is common in this kind of research.

Share this Post

Published May 25, 2020

Topics: Nonprofit Development