The Business Savvy of Christian Investing

[Have you ever thought about whether your 401(k) or your investment portfolio aligns with your values? And should it? Perhaps you’ve suspected that if you invested in true alignment with your values that you’d achieve a lesser return? Here’s a great post from my friend Rachel McDonough that will perhaps raise some new thinking for you—on investing to match your values. – Bill]

When Frank came into my office, he had already heard of Faith-Based or Biblically Responsible Investing (BRI) but he was pretty sure it wasn’t a good idea. As a retired sales executive with a high net worth and a deeply held faith, he included generous charitable giving in his financial plan. However, in his mind, choosing an investment strategy was a business decision.

When asked about his potential interest in aligning his investments with his values for positive impact and financial return, he said, “The way I see it, giving is giving. And investing is investing. I’m not sure I feel comfortable blurring the lines there.”

What Frank did not yet know was that, of the investment options at our disposal, several of the better performing strategies were indeed those that considered non-financial criteria related to ethics, responsibility, sustainability, and other values.

Frank is not alone in assuming there will be less upside potential in investments that apply a values filter. After all, such strategies often involve slightly higher fees than their conventional invest-anywhere counterparts.

“What will it cost me (in the form of a lower rate of return and/or higher fees) to align my investments with my values?” is the number one concern or question I hear when sitting down with a prospective investor who is learning about this concept for the first time.

Many investors assume that if they eliminate companies and industries that do harm (like pornography, gambling, tobacco, etc.) and intentionally seek companies that are creating valuable, positive goods and services that promote human flourishing, there simply won’t be many financially attractive investments left!

BRI Investments Can Hold Their Own

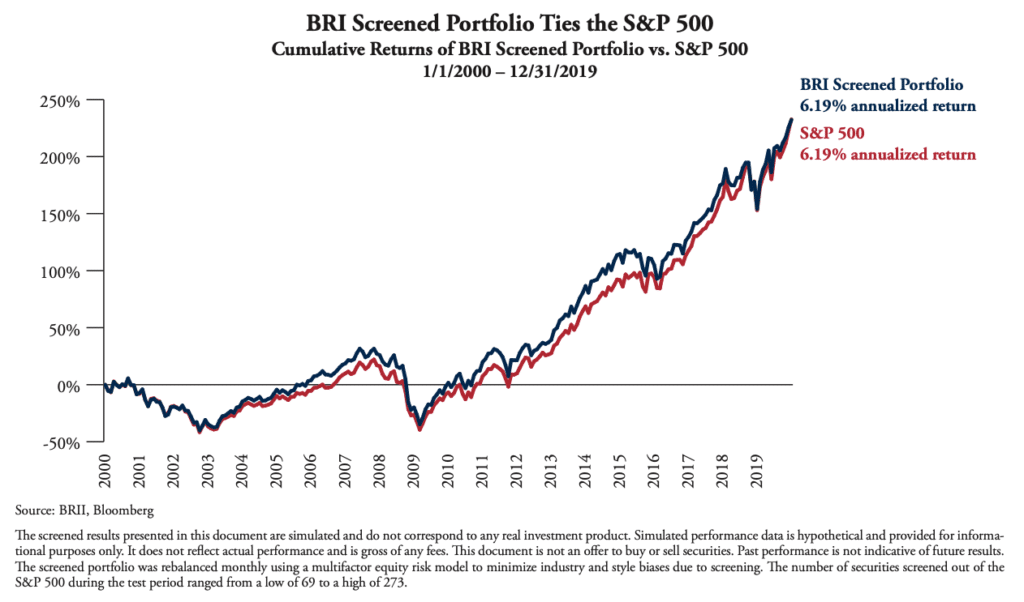

To address the performance impact of so-called “exclusionary screening” (taking out the bad stuff) on performance, I think the 2019 study from the Biblically Responsible Investing Institute does a great job of presenting data in an unbiased manner (which is difficult to find in a world where nearly every academic study is tied to the agenda of the publisher). It also uses a rather rigorous interpretation of Christian values, meaning more companies would have been removed from this sample than many other faith-based investment companies would remove with their less restrictive approaches. So, this may give us a worst-case scenario of sorts, where we are excluding a larger number of potentially profitable companies, purely for ethical reasons.

In the study, which examined performance from 1/1/2000 to 12/31/2019, a 20-year time period, both the “BRI Screened Portfolio” and the S&P 500 benchmark have an identical 6.19% annualized return. While there were shorter time periods where one or the other outperformed, by the end of the sample 20-year period, they were literally neck and neck.

Note: This study does not account for the potential positive impact on performance that could arise from trying to identify positive impact companies, which we might logically conclude should be more inclined to experience greater success in business by way of customer loyalty, positive reviews, referrals, etc.

Note: This study does not account for the potential positive impact on performance that could arise from trying to identify positive impact companies, which we might logically conclude should be more inclined to experience greater success in business by way of customer loyalty, positive reviews, referrals, etc.

Ethical Investing Is Sound Strategy

As a Certified Financial Planner™ professional and a Certified Kingdom Advisor™, I have a duty to act in a fiduciary capacity with my clients and to put their interests ahead of my own. And, while I cannot make specific investment recommendations for readers, in my professional opinion, I believe this style of investing has merit as a savvy investment strategy. I’ve seen real clients successfully navigate both the accumulation and the distribution phases of wealth management using this approach.

I get it. These are real dollars and real needs, such as being able to afford healthcare in retirement. None of us want to lose money or run out of money before we die. I’ve accumulated hundreds of hours of professional education and I invest a lot of time and energy in doing analysis of various funds, talking with fund managers, and monitoring risk and returns. But the reality is that there is no way of guaranteeing that we have chosen the investment strategy that will be the top performer. In fact, the strategies that performed best last year probably won’t be the best next year since they tend to go in and out of favor. That’s why using our faith values as a foundation for investing is so refreshing and appealing.

Confidence & Contentment

When we put biblical wisdom into action by choosing an investment approach that aligns with God’s heart, with companies that benefit humanity, we find an approach that we can believe in and understand. This is indeed savvy because it makes it so much easier for us to stay the course in turbulent times. The strong urge to sell investments when the portfolio is down is one of the top reasons why most retail investors underperform.

In addition to the business savvy that comes from staying the course, we can experience greater contentment, joy, and a sense of wholeness. When we are not willing to profit from someone else’s addiction (like gambling) or oppression (like human trafficking), we are demonstrating that we trust God to be our Provider.

Photo by Ashton Bingham on Unsplash

Share this Post

Published September 23, 2020

Topics: Family Business